Feb-2025

Potential of renewable fuels and SAF

A discussion of current technologies that can allow pivoting from renewable diesel to SAF and even revert to the full production of fossil fuels, as markets dictate.

Woody Shiflett

Blue Ridge Consulting

Viewed : 1990

Article Summary

The last decade has seen sustained demand growth (see Figure 1) in renewable fuels, building on more than two decades of technology development and commercialisation. Many efforts have been built upon the foundations of mature refining technologies such as hydrotreating and hydrocracking or more direct and simple processes such as transesterification to produce fatty acid methyl esters (FAME) for mainly biodiesel applications.

Production of sustainable aviation fuel (SAF) has certainly lagged in absolute volume terms compared to renewable diesel (RD) and biodiesel (BD). More recently, however, SAF has shown notable growth rates, especially considering its small production volumes a few years ago (see Figure 2). Currently, the RD and BD domains are facing challenges, notably the collapse of US renewable identification numbers (RIN) pricing (see Figure 3), an oversupply of BD/RD in the EU, and announced plant closures or repurposing.3,5

SAF potential

Against this backdrop, could SAF serve as a refuge and placeholder in the renewables arena, given its global infrastructure and existing commercial and regulatory commitments? This potential, regarding anticipated future demand, will be examined along with current technologies that can enable a pivot from RD to SAF, with the ability to even revert to the full production of fossil fuels, as markets dictate.

There may be some basis for starry-eyed optimism for significant SAF growth within this decade. In its base case scenario, the International Energy Agency (IEA) projects a 2,600% growth in global SAF demand from 2023 to 2028, rising to approximately 5.2 billion litres/year (~90,000 barrels/day), or about 1.1% of total projected demand. This is contrasted with the corresponding IEA projection for ‘only’ 200% growth in RD to 26.4 billion litres/year (455,000 barrels/day), or about 1.5% of projected demand.

The International Air Transport Association (IATA) issued an even more bullish recommendation to reduce aviation carbon intensity by 5% by 2030. This was agreed during the Third Conference on Aviation and Alternative Fuels (CAAF/3 – November 2023), calling for 17.5 billion litres/year (300,000 barrels/day) by 2030. Additionally, the US Departments of Energy, Transportation, and Agriculture (DOE, DOT, and USDA) have formulated a SAF Grand Challenge, aiming for domestic SAF production to reach 3 billion gallons (11 billion litres/year or 200,000 barrels/day) annually by 2030.

Regional uncertainty and differences in regulations, incentives, and subsidies for RD, contrasted with the more global, fungible nature of jet fuel, offer the potential to drive SAF production. Nonetheless, near-term projections still put RD demand a factor of four or five above that for SAF, highlighting certain alternatives that could offer fuels providers some risk mitigation.

One set of alternatives, considering the vast hydroprocessing infrastructure in place for the production of fossil fuels, is hydroprocessing paths. These are often denoted as HEFA-SPK (hydrotreated esters and fatty acids to synthetic paraffinic kerosene) or HRJ (hydroprocessed renewable jet). Hydrotreated vegetable oil (HVO) is another generic term used to describe diesel and jet range products despite the implication that animal fats are excluded.

Technically, HVO is a HEFA; hence, the latter term is more inclusive. Co-processing routes to SAF, as well as revamped hydrotreaters and hydrocrackers for full renewables production, allow not only selectivity adjustment to yields for SAF and RD but can also enable a total pivot between fossil fuel production and renewable fuel production as market climate and regulatory pace dictate.

High SAF yield technologies, approaching 100% or more liquid yield from renewable feedstocks, merit consideration such as ethanol-to-jet (ATJ-SPK) and gas-to-liquids (GTL-SPK) production of SAF.

Significant projects are underway for the latter two paths. Table 1 (adapted from reference 6) provides some perspective on players and technologies. It should be noted that some of the companies listed are no longer financially stable.

Fundamental chemistry of HEFA processes

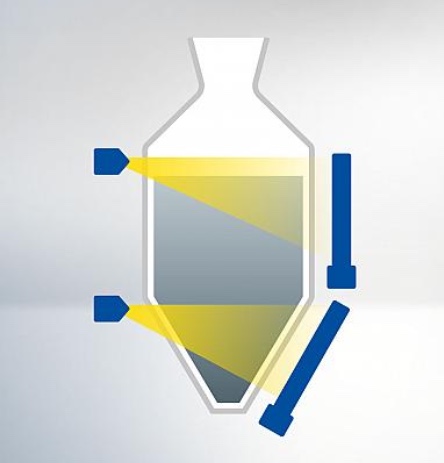

The first step in SAF production is the complete hydrogenation and deoxygenation of the lipid triglycerides found in the renewable feeds that have been pretreated to make them suitable for hydroprocessing. The triglycerides are comprised of three linear fatty acid chains bound by a glycerol backbone. Figure 47 illustrates the potential reaction pathways for a representative triglyceride molecule found in rapeseed oil. The hydrodeoxygenation path (HDO) is favoured because it conserves renewable carbon atoms in the fuel being produced rather than in CO and CO₂ as byproducts. Specific heterogeneous catalyst systems allow selectivity to the favoured reaction sequence, as will be noted later.

Several points are key from Figure 4, including considerably more hydrogen is consumed for the HDO pathway than in fossil fuel hydrotreating operations (four to five times greater), more even in the range beyond most hydrocracking operations (up to twice as much). The production of water by deoxygenating fatty acid chains and the saturation of olefin bonds are highly exothermic. This predicates a hydrogen supply not only for chemical consumption but also for quench gas, the latter depending on how much liquid recycle is employed to control temperature rise.

High amounts of propane, water, carbon monoxide, carbon dioxide, and methane off-gases are generated compared to fossil fuel hydroprocessing. The various lipid sources for HEFA contain a myriad of variable contaminants that must be removed to tenable levels for hydroprocessing. Table 2 lists typical contaminants and levels and the range of levels specified by technology providers for their hydroprocessing systems.8

Contaminant metals include alkali and alkali earth metals (Na, K, Ca, Mg) that are often part of acid salts, as well as Fe, B, Si, Zn, and Al. The presence of phospholipids, compounds similar to triglycerides except one fatty acid chain has been replaced by a phosphate group chain, in renewable feeds can be an issue in deactivation by phosphorus, even at parts per million levels. Operators of HEFA units must either install pretreatment units (PTUs) or purchase pretreated renewable feedstocks.

When considering the fatty acid chain composition range of a number of representative renewable feedstocks, it is easily noted that the resultant paraffin products from HEFA processes will produce a significant amount of C18+ (and C17 paraffins if appreciable decarboxylation occurs), which exceeds the desirable C8-C16 range for jet fuel. This dictates that a hydrocracking component will be required in a HEFA-SPK process for SAF production. Furthermore, the product paraffin content is inadequate to meet the cold flow properties required for jet fuel needs. Hence, a hydroisomerisation, or dewaxing, step will also be required. Fortunately, existing hydroprocessing technologies can incorporate both, which will be discussed subsequently.

Co-processing renewables with fossil fuel feeds

For fossil fuel refiners, a straightforward entry into SAF production is to utilise existing hydroprocessing units, appropriately modified, to co-process some percentage of renewable feedstocks with petroleum feedstocks. Co-processing in hydrocracking and distillate hydrotreating units is an option that has been actively employed in refining scenarios for well over a decade.7

Add your rating:

Current Rating: 4